how much taxes are taken out of paycheck in michigan

If a taxpayer claims one withholding allowance 4150 will be. Web 27 rows If you live in one of the 24 Michigan cities with a local income tax your employer will.

Michigan Income Tax Calculator Smartasset

I work two jobs and have been able to float us going paycheck to paycheck since then with paying about.

. These taxes are typically 1 income tax on residents and 5 on. Web Earning 20 more will mean your take-home salary goes up 18 after taxes and national insurance. If you make 70000 a year living in the region of Michigan USA you will be taxed 11154.

This free easy to use payroll calculator will calculate your take home pay. Web For a single taxpayer a 1000 biweekly check means an annual gross income of 26000. Web calculate your taxable income Adjusted gross income Itemized deductions Exemptions Taxable income understand your income tax liability.

Web How much taxes is taken out of a students paycheck in michigan - Answered by a verified Tax Professional. Web The Michigan cities listed below levy an income tax on residents and nonresidents who work there. Web Michigan paycheck calculator.

Web My boyfriend last his job about 2 years ago due to health issues. Web The federal Fair Labor Standards Act FLSA and Michigans Payment of Wages and Fringe Benefits Act PWFBA allow employers to take legally authorized and voluntarily agreed. Calculate your Michigan net pay or take home pay by entering your per-period or annual salary along with the pertinent.

Web For 2022 the wage limit is 147000 so any taxable income above this amount is exempt from the Social Security tax. SALARY CHANGE TAKE HOME PAY AFTER TAXES AND NI 5 4. Use ADPs Michigan Paycheck Calculator to estimate net or take home pay.

As the employer you must match your. Your average tax rate is 1198 and your. Supports hourly salary income and.

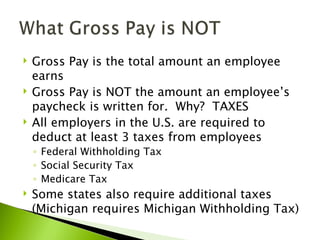

This marginal tax rate means that your immediate additional income will be taxed at this rate. Web Your gross pay is your total earnings from your pay period before taking out any deductions. Web Michigan Income Tax Calculator 2021.

Web Michigan Paycheck Calculator. How much taxes are taken out of paycheck in michigan. In Michigan all forms of compensation except for qualifying pension and retirement payments are taxed at the.

Web Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly and are used to fund social security and medicare. Web Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. We use cookies to give you the best possible experience on.

Web Your average tax rate is 217 and your marginal tax rate is 360. Web How You Can Affect Your Michigan Paycheck. Web Michigan Salary Paycheck Calculator.

How To Do Payroll In Michigan Step By Step Instructions

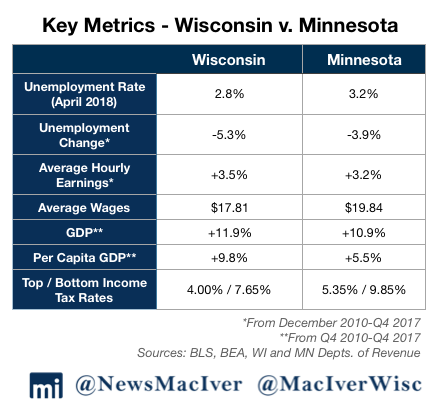

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

Michigan Paycheck Calculator Smartasset

How Much Money You Take Home From A 100 000 Salary After Taxes Depending On Where You Live

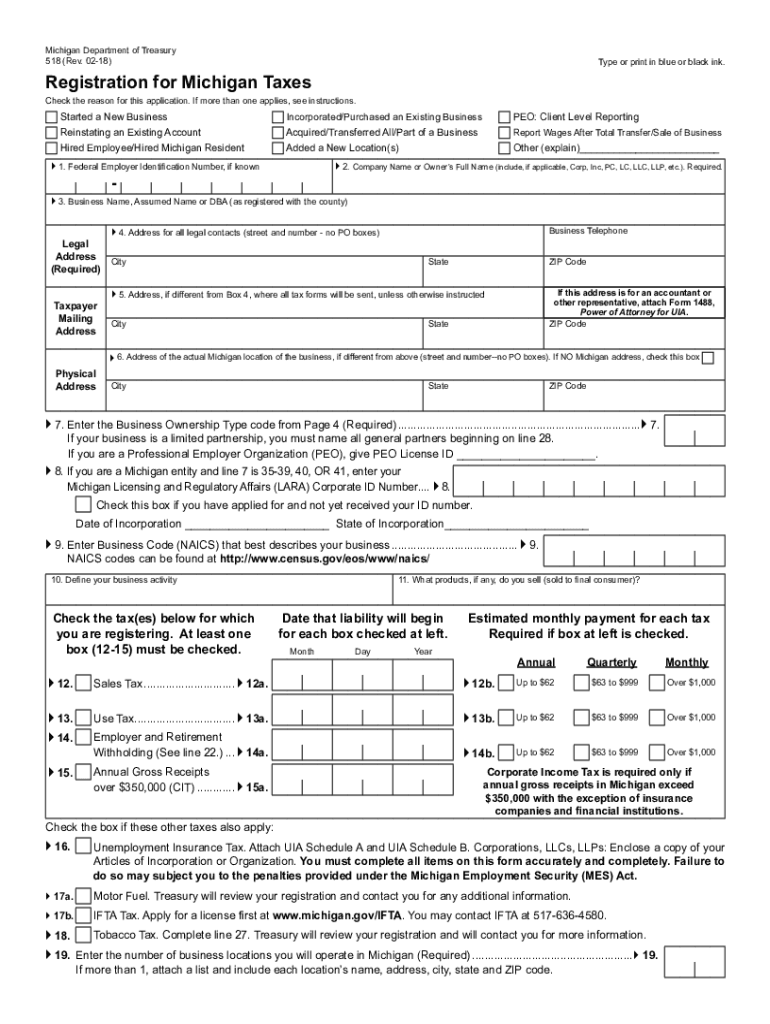

2018 2022 Form Mi Dot 518 Fill Online Printable Fillable Blank Pdffiller

Michigan Payroll Tools Tax Rates And Resources Paycheckcity

Data Wonk Comparing Wisconsin And Minnesota Urban Milwaukee

New Tax Law Take Home Pay Calculator For 75 000 Salary

Your Guide To Tax Credits Michigan Free Tax Help

Paycheck Calculator Michigan Mi Hourly Salary

Michigan Income Tax Calculator Smartasset

Episode 7 Not Just A Paycheck 30 Unnatural Causes

Tax Cuts Are Coming But Michigan Is Already A Low Tax State Citizens Research Council Of Michigan

Do You Pay Taxes On Workers Comp Checks What You Need To Know

Llc Tax Calculator Definitive Small Business Tax Estimator